In uncertain times where change is frequent and rapid, you may think it’s the wrong time to look at new ways to invest your money. But some things don’t change, and that’s true when it comes to sound investing strategies – there are a number of golden rules that have served investors well through the ages and continue to stand the test of time.

1 Diversify, diversify, diversify

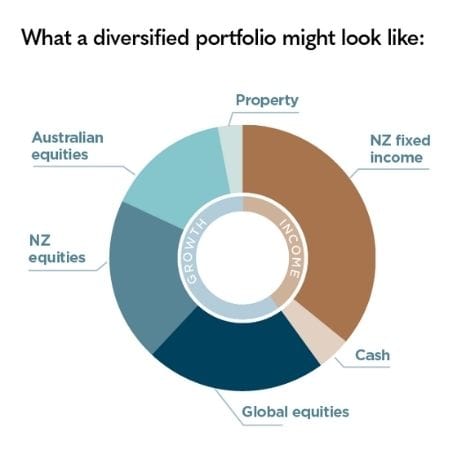

This is one of the easiest things you can do, but the benefits can be significant. As investment adviser Amelia Wong at Craigs Investment Partners explains, “No-one knows for sure what will happen in the future and how markets will react to changes or announcements, so having a diversified portfolio, made up of different assets and shares from different sectors and geographic markets, lowers your overall risk and improves the likelihood you’ll be a successful investor. Plus, you’ll be able to sleep soundly at night knowing negative performance in one area of your portfolio can be balanced by positive performance in other investments.”

2 Invest in quality

Investing in quality companies has always been a core belief at Craigs Investment Partners, and right now it’s particularly important. So, what makes a quality company?

“By ‘quality’ we mean companies that have unique products, intellectual property and sustainable competitive advantages, and a history of producing returns for shareholders. These are the types of companies that we expect will still exist in 50 years’ time,” adds Wong.

3 Shut out the noise

This means trying not to obsess about short-term market movements. Warren Buffett once said, “Games are won by players who focus on the playing field – not by those whose eyes are glued to the scoreboard.” That’s something to keep in mind with investing. Yes, share prices will fluctuate – that is just part of investing, but despite the peaks and troughs for shares in the short term, it can result in much higher returns over the long term. “The thing with financial markets is that the further ahead in the future you look, the more predictable things often become. That’s the opposite of just about everything else in life. Markets are very hard to predict over days, weeks, months or even years. But the likely returns become much easier to see as we look further ahead. The hard bit as an investor is keeping your cool and remembering that,” explains Wong.

Craigs are advocates for investing in instalments, like a savings plan, where you allocate from $100 per month toward your investing. With this approach you take some of the guesswork out of investing, allowing you to continually purchase through dips and peaks, averaging out the cost over time.

4 Don’t delay

There really is no benefit to waiting when it comes to investing. That’s why Craigs Investment Adviser Laura O’Reilly encourages investors to start as early as they can. “The more you delay, the more you could miss out on the benefits. If your goal is to build up wealth gradually, time in the market maximises the effects of compounding returns and can magnify your gains over time.”

Many people approach Craigs when they have experienced a significant milestone, perhaps sold a business that they have worked hard to build up or they have accumulated money over time and now need to ensure they can generate an income to love a financially worry-free life in retirement. It’s a time when many find themselves confused about the myriad options and feel they lack the knowledge and confidence to invest.

This is the main reason why both Wong and O’Reilly are involved with Craigs’ Women’s Wealth programme – to encourage and educate more women to discover investing in a friendly, informative environment.

5 Have a plan and stick to it

Investing should never be ‘one size fits all’. Working with Craigs means building an investment plan and portfolio tailored to your life stage, financial situation, goals and values. “We collaborate with each client to determine your capacity and appetite for risk depending on your situation. This will avoid unfavourable situations, such as having a portfolio that is too risky and having to call on your money quickly (say for a house or retirement) when that market is going through a rough patch; or being too conservative for a long-term horizon and missing out on better returns,” says O’Reilly.

6. Get advice

These rules are simple and yet the finer details of them are undoubtedly easier to understand and implement with the help of an expert. Craigs Investment Partners has over 170 qualified investment advisers across 19 branches from Kerikeri to Invercargill on hand to help. Their job is to make your investment journey simple and enjoyable. They know how to create a portfolio that works to your needs and delivers results.

So, what are you waiting for?

If you have been thinking about investing for a month or so, that’s a month’s worth of potential returns or income you may have potentially missed out on. Get in touch with a Craigs Investment Adviser for a no-obligation initial consultation – the only cost is your time.

To discuss your investment goals and needs, contact a Craigs Investment Adviser for a free, no-obligation consultation. They will help you understand the most suitable options based on your circumstances. Phone 0800 272 442 or visit craigsip.com.

To learn more about Women’s Wealth, visit craigsip.com/womens-wealth.

This graphic is for illustrative purposes and is intended as a generic example only. No reliance should be placed on it and before making investment decisions it is recommended you contact an investment adviser.

Disclaimer: This article is general in nature and does not constitute regulated financial advice. It does not take into account your particular financial situation, objectives, goals, or risk tolerance. Investments are subject to risk and are not guaranteed. Past returns are no guarantee of future performance and returns can go down as well as up. Before making any investment decision Craigs Investment Partners Limited recommends you contact an investment adviser. For more information on Craigs financial advice services please see craigsip.com/tcs